We’ll find few issues out there that transcend the chaos and fighting that takes place daily on Capitol Hill.

Take a second and close your eyes, then try to think of a single topic that both the far left and far right can agree on.

Don’t worry, I’ll wait.

Still need help?

Here’s a hint: Every four years, the American Society of Civil Engineers releases a report that shows us — Republican, Democrat, and all — just how perilous our country’s infrastructure has become.

Their last report was made public in 2017, and anyone who gave it even the most cursory of glances could tell you we’re in trouble.

How bad was it? Put it this way: That report gave the U.S. infrastructure a D+ grade… and the numbers are downright scary.

But don’t worry — this story does have a happy ending… for the right investors.

This Is Why Congress Is Pumping Your Portfolio

Just consider…

One out of every three roads is in substandard condition. Roughly two out of every five miles of our urban interstates are congested, with traffic delays costing an eye-gouging $160 BILLION in wasted time and fuel.

Out of more than 600,000 bridges located inside the United States, almost 40% are over 50 years old, and more than 9.1% — or roughly 56,000 — were labeled structurally deficient in 2016!

Most of the 1 million miles of water pipes in the U.S. were put in place nearly a century ago, and the 240,000 water main breaks that occur every year waste more than 2 trillion gallons of drinking water; the amount of investment that is needed to meet our demands over the next 25 years tops more than a trillion dollars.

Again, that’s just scratching the surface of this crisis.

Push the doom and gloom aside for a minute, dear reader. I’m not writing to you today to highlight the nightmarish scenarios that await inaction.

Like I said, it’s the one crisis that can bring together both sides in Washington.

Here’s the catch: It already has!

A few weeks ago, a small meeting in the White House took place between President Trump and Democratic leaders in Congress.

It lasted just 90 minutes, and what happened next was nothing short of a miracle.

Both sides agreed to a $2 trillion infrastructure plan. The money would be spent repairing bridges, roads, and even our water infrastructure. The details have yet to be revealed, but there’s talk that bolstering our power grid was high on the list of priorities.

Now they just have to work out how to pay for it.

5 Oil Investments Better Than Exxon

There’s another infrastructure story you won’t see the mainstream media touch.

Right now, there are 2.6 million miles of oil and gas pipelines crisscrossing the United States.

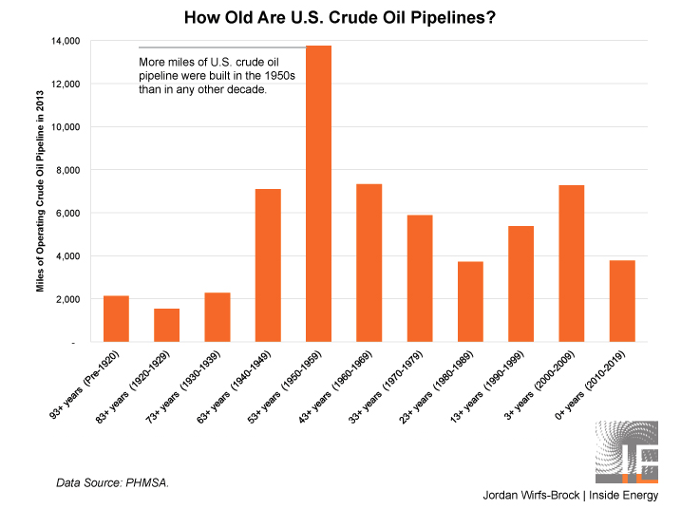

Nearly half of those pipelines are more than 50 years old.

About 10% of our crude oil pipelines were laid down more than 70 years ago.

Take a look for yourself:

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

I’ve told you before that sometimes the best investments are hiding in plain sight.

Well, this is one investors can’t ignore.

Just remember what’s at stake here.

For the first time in decades, the United States has become a global powerhouse in energy.

The 12.2 million barrels of oil we produce every day is more than any other nation on the planet.

Texas alone produces more oil than all but one OPEC member!

And the bitter pill to swallow is that not only are our oil pipelines old, but there aren’t enough of them to keep pace with output in our biggest oil plays like the Permian Basin.

You see the opportunity now, don’t you?

Thing is, President Trump isn’t going to wait for Congress to act on this pipeline crisis.

On April 10, 2019, he signed two executive orders that will speed up the construction of new oil and gas pipelines.

This is good news for states like Texas, where pipeline bottlenecks are taking their toll on drillers.

And it’s opened the door wide open for individual investors like us.

That’s why I’ve put together this new special report for you today.

Inside, I’ll show you exactly how to take advantage of this situation, including five must-own oil investments that are perfectly positioned to help solve this infrastructure crisis.

I urge you to take a few minutes out of your day and check out the full details for yourself — you can find my investment presentation here.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.